Reducing your company’s inventory costs is never as simple as just cutting back on inventory levels.

It’s ultimately about buying exactly what you need when you need and having the right amount of inventory to cover customer demand.

When faced with this situation, companies invariably turn to calculating their economic order quantity (EOQ).

What Goes Into Your Costs of Inventory?

In order to properly calculate your EOQ, you must first have a solid grasp of why inventory is so expensive.

There are really just two main costs of managing inventory. First, there are costs of having inventory on your shelves and not having enough customer demand. These are referred to as carrying costs.

Second, there is the cost of not having products on your shelves and having too much customer demand. These are referred to as lost sales or lost business costs of inventory due to stock-outs. One measures carrying costs, while the other measures lost business.

Most companies focus on their carrying costs, while ignoring, or better put, not understanding the second cost of lost business due to low inventory levels.

However, when your sales team loses business because you don’t have inventory, then you can easily define those costs by amalgamating the lost profit and lost customers that resulted from not having the inventory you needed to close business.

Better yet, if you decide not to lose any business due to a stock out, then you’ll probably incur additional expedite fees to rush product into your warehouse and out to your customer.

The following two tables outline both of these aforementioned cost drivers in detail. For the purposes of our analysis, and the EOQ calculation, we’ll apply 3% as our monthly inventory carrying cost.

This 3% monthly cost is a standard percentage that companies apply to the inventory value in any given month. The best enterprises are often below this 3%. However, the majority of companies are either at this 3%, or even higher. ith local markets and suppliers.

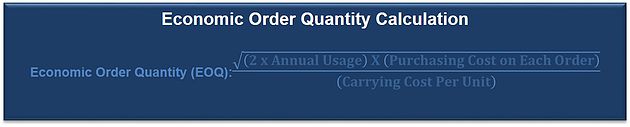

The EOQ Calculation

Your economic order quantity is that ideal quantity where you’ve lowered your costs of inventory relative to your costs to purchase that inventory. You use your EOQ to minimise both the aforementioned inventory cost drivers. Ultimately, it’s that all-importance balance between high inventory counts and low inventory counts.

There are essentially four portions to the EOQ calculation:

First, you must define your total annual usage of the product, raw material or item you purchase.

Second, you must define the price of the item you are purchasing from your vendors.

Third, you must define your company’s purchasing cost for each order you place.

Finally, you must define your carrying costs for each unit you purchase.

The EOQ calculation is provided below.

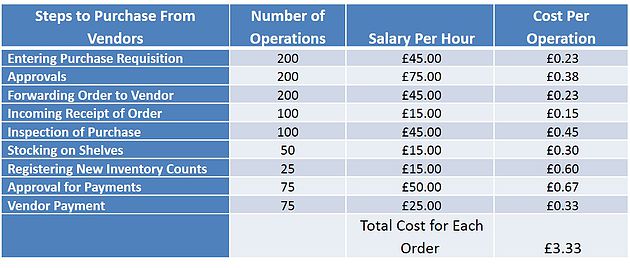

Determining Your Costs to Purchase

Your company must cover a cost to purchase raw materials, consumables and or finished goods. Every time you place an order with your vendor, you must cover this cost. So, what is included in these costs?

First, there are costs to place the order. These costs are defined by the time needed to generate a purchase requisition in your company’s system, the time needed for approvals from senior purchasing directors, and finally, the time needed to forward and discuss that order with your vendor.

Second, there are costs associated with actually receiving the order into your warehouse. This includes incoming receipt and inspection.

Third, there are costs associated with stocking the parts on the shelf and accounting for that product by registering the receipt of that item into your system.

Finally, there are costs associated with remitting payment to your vendor. This includes accounting getting approvals with signatures, and then remitting payment to the vendor for your purchase.

Determining Your Costs for Each Purchase

Determining your costs to purchase can be a time-consuming affair. This is especially the case if you rely upon excel sheets and or word documents to track purchases.

However, if you have a material resource planning (MRP) and or enterprise resource planning (ERP) software, then calculating your costs to make a purchase should be much easier.

However, if you need to better understand how these costs are calculated, then the following table will provide the guidance you need.

We’ve taken each of those aforementioned steps involved in placing an order and outlined them in the table below on the far left.

Next, we’ve accounted for the total number of operations each step entailed.

We’ve then accounted for the hourly salary for each individual performing those operations. We’ve then taken the corresponding hourly salary and divided it by the number of operations. This gives us our “cost per operation”.

Finally, we’ve totalled all the costs per operation in order to come up with our total cost for each order, which in our example is £3.33.

Example EOQ Calculation:

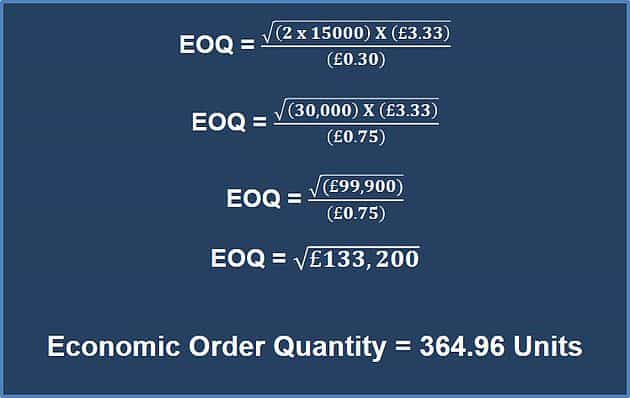

In our example, we’ll assume that the company purchases 15000 widgets during a given year. The price for those widgets is £25.00 each. The company’s carrying costs of 3% are then multiplied by this £25.00, which gives us £0.75 carrying cost on each unit. Finally, the company’s total purchasing costs for every order is £3.33, which comes from the table above.

Here is the EOQ calculation with the answer being the ideal quantity the company should purchase.

The only thing that remains to be determined now is the number of orders the company will place in a given year. This simply involves taking the 15,000 units and dividing it by the EOQ of 364.96 which gives us 41 separate orders placed during a given year. This information now allows the company to better plan its purchases with its vendors.

The EOQ calculation above is known as the “Wilson EOQ Formula”. It’s a formula that has been used for well over 100 years and is widely recognised as the primary way to calculate a company’s economic order quantity.

Understanding why your company covers a carrying cost of inventory, and why it covers a cost to not have inventory, is critical to making sure you use this calculation properly.